90+ pages assume that both portfolios a and b are well diversified 2.3mb answer in Google Sheet format . Omit the sign in your response. Assume that both portfolios A andB are well diversified that ErA 12 and ErB 9Assume the economy has only one risk fac tor thebeta of A 12 and the beta of B 08Using the expected return-beta relationship what must be the riskfreerate. If the economy has only one factor and A 1 while B 11 what must be the risk-free rate. Read also assume and assume that both portfolios a and b are well diversified Assume that both Portfolios A and B are well diversified that ErA _ 12 and ErB _ 9.

Get Your Custom Essay on Assume that both portfolios. If the economy has only one factor and A 12 whereas B 8 SolutionInn.

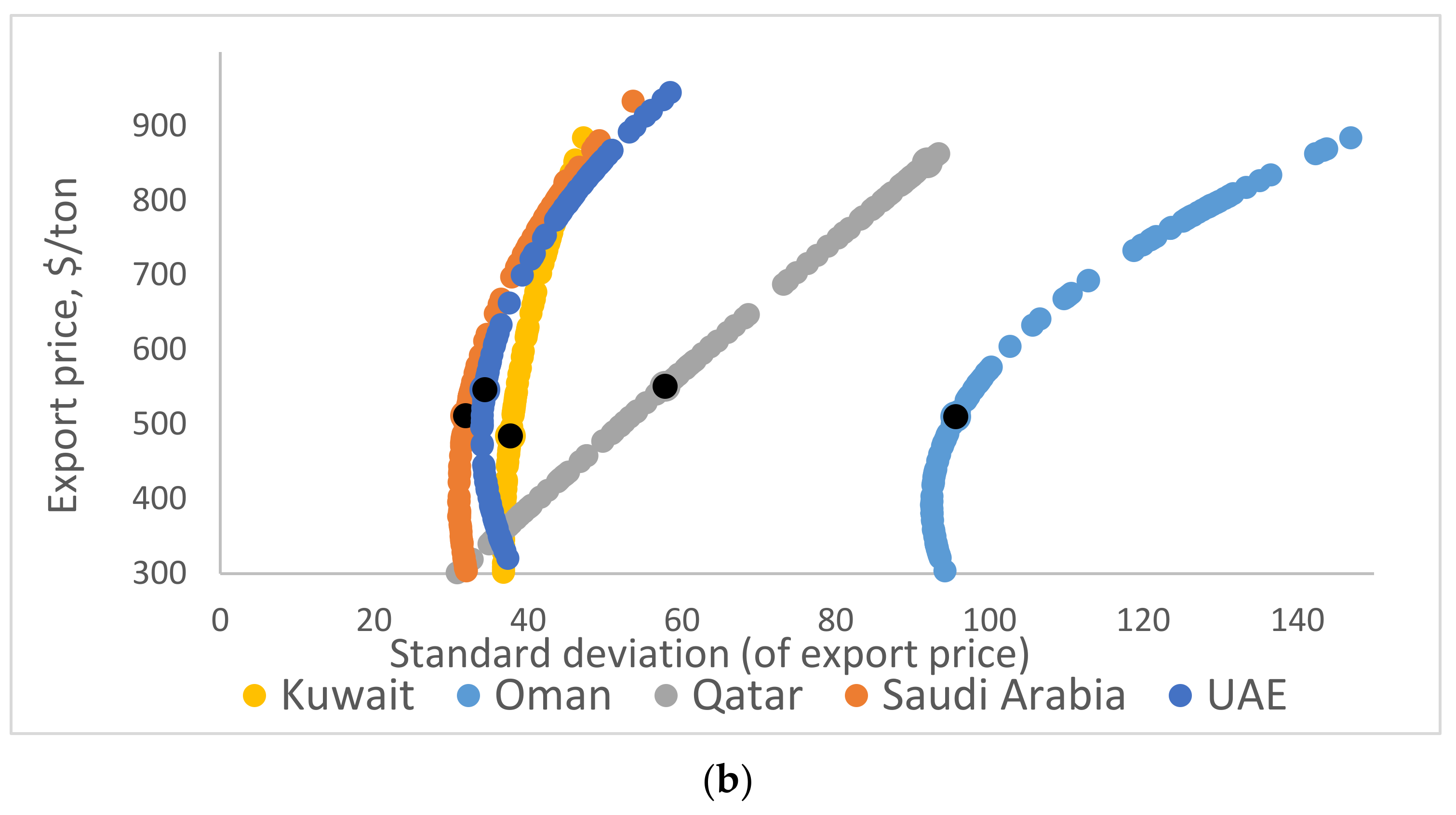

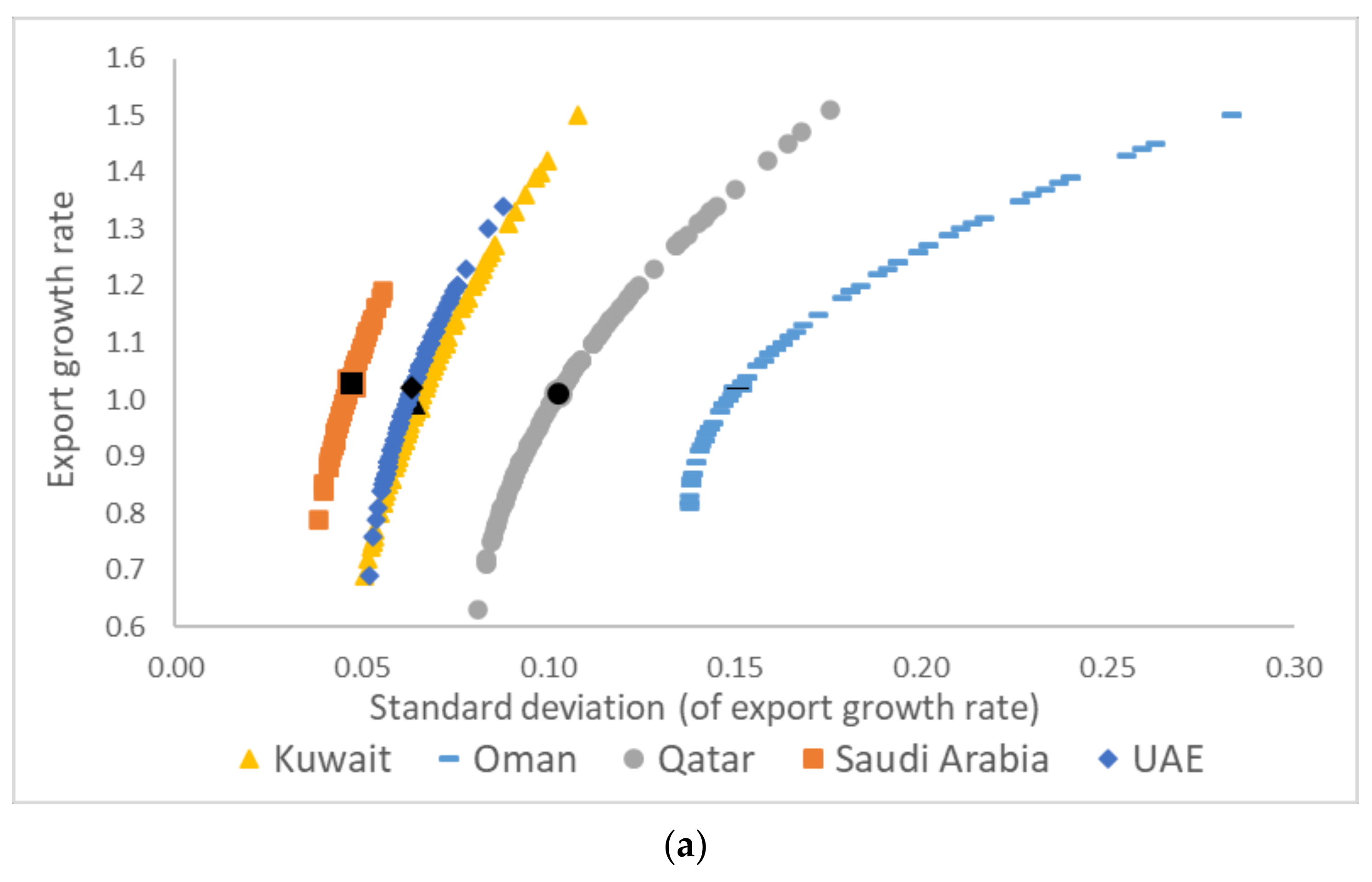

Energies Free Full Text Energy Security And Portfolio Diversification Conventional And Novel Perspectives Html

| Title: Energies Free Full Text Energy Security And Portfolio Diversification Conventional And Novel Perspectives Html Assume That Both Portfolios A And B Are Well Diversified |

| Format: Doc |

| Number of Views: 8207+ times |

| Number of Pages: 248+ pages about Assume That Both Portfolios A And B Are Well Diversified |

| Publication Date: September 2019 |

| Document Size: 2.6mb |

| Read Energies Free Full Text Energy Security And Portfolio Diversification Conventional And Novel Perspectives Html |

|

If the economy has only one factor and A 15 whereas B 11 what must be the risk-free rate.

Assume that both portfolios A and B are well diversified that ErA 22 and ErB 17. 1 on a question Assume that both portfolios A and B are well diversified that ErA 12 and ErB 9. If the economy has only one factor and A. Assume that stock market returns have the market index as a common factor and that all stocks in the economy have a beta of 1 on the market index. Dont use plagiarized sources. Assume that stock market returns have the market index as a common factor and that all stocks in the economy have a beta of 1 on the market index.

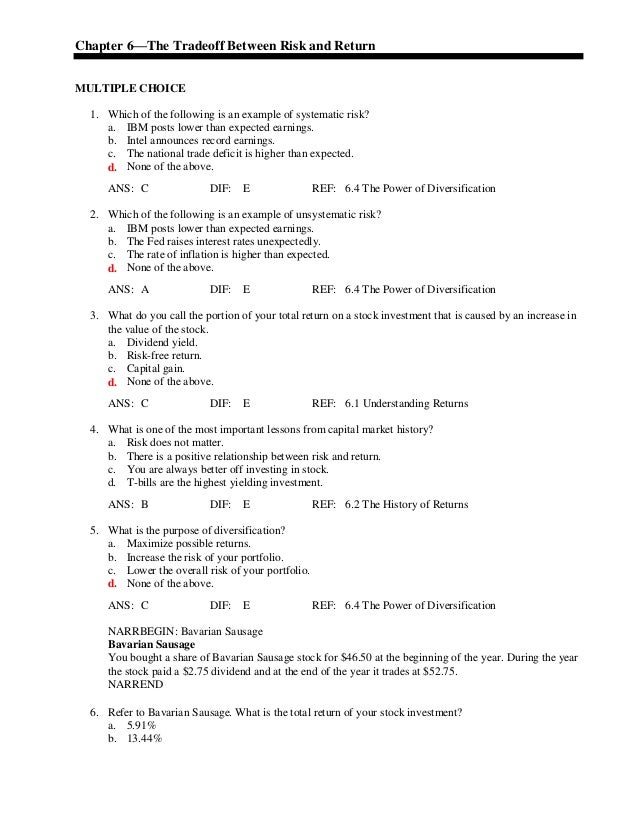

Test

| Title: Test Assume That Both Portfolios A And B Are Well Diversified |

| Format: Doc |

| Number of Views: 3270+ times |

| Number of Pages: 141+ pages about Assume That Both Portfolios A And B Are Well Diversified |

| Publication Date: July 2020 |

| Document Size: 3.4mb |

| Read Test |

|

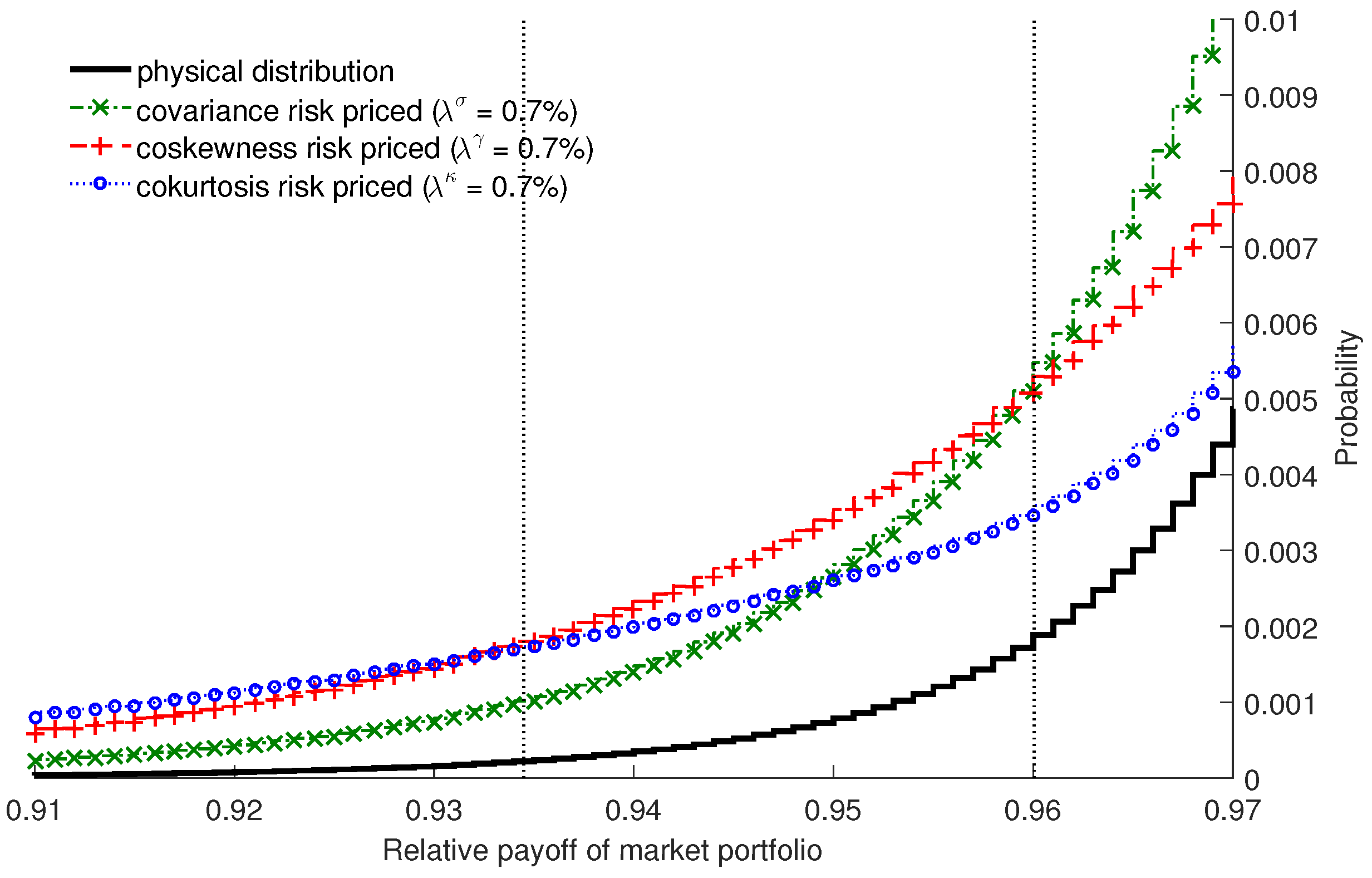

Jrfm Free Full Text Credit Rating And Pricing Poles Apart Html

| Title: Jrfm Free Full Text Credit Rating And Pricing Poles Apart Html Assume That Both Portfolios A And B Are Well Diversified |

| Format: Doc |

| Number of Views: 6170+ times |

| Number of Pages: 139+ pages about Assume That Both Portfolios A And B Are Well Diversified |

| Publication Date: October 2020 |

| Document Size: 2.2mb |

| Read Jrfm Free Full Text Credit Rating And Pricing Poles Apart Html |

|

Mean Variance Model For Portfolio Selection Fabozzi Major Reference Works Wiley Online Library

| Title: Mean Variance Model For Portfolio Selection Fabozzi Major Reference Works Wiley Online Library Assume That Both Portfolios A And B Are Well Diversified |

| Format: PDF |

| Number of Views: 3010+ times |

| Number of Pages: 254+ pages about Assume That Both Portfolios A And B Are Well Diversified |

| Publication Date: February 2017 |

| Document Size: 1.35mb |

| Read Mean Variance Model For Portfolio Selection Fabozzi Major Reference Works Wiley Online Library |

|

The Risk Contribution Of Stocks The Hedge Fund Journal

| Title: The Risk Contribution Of Stocks The Hedge Fund Journal Assume That Both Portfolios A And B Are Well Diversified |

| Format: Doc |

| Number of Views: 3090+ times |

| Number of Pages: 25+ pages about Assume That Both Portfolios A And B Are Well Diversified |

| Publication Date: March 2019 |

| Document Size: 1.35mb |

| Read The Risk Contribution Of Stocks The Hedge Fund Journal |

|

Energies Free Full Text Energy Security And Portfolio Diversification Conventional And Novel Perspectives Html

| Title: Energies Free Full Text Energy Security And Portfolio Diversification Conventional And Novel Perspectives Html Assume That Both Portfolios A And B Are Well Diversified |

| Format: Google Sheet |

| Number of Views: 7156+ times |

| Number of Pages: 5+ pages about Assume That Both Portfolios A And B Are Well Diversified |

| Publication Date: September 2019 |

| Document Size: 1.3mb |

| Read Energies Free Full Text Energy Security And Portfolio Diversification Conventional And Novel Perspectives Html |

|

Entropy Free Full Text A Simple View On The Interval And Fuzzy Portfolio Selection Problems Html

| Title: Entropy Free Full Text A Simple View On The Interval And Fuzzy Portfolio Selection Problems Html Assume That Both Portfolios A And B Are Well Diversified |

| Format: Google Sheet |

| Number of Views: 3480+ times |

| Number of Pages: 202+ pages about Assume That Both Portfolios A And B Are Well Diversified |

| Publication Date: July 2019 |

| Document Size: 1.4mb |

| Read Entropy Free Full Text A Simple View On The Interval And Fuzzy Portfolio Selection Problems Html |

|

Energies Free Full Text Energy Security And Portfolio Diversification Conventional And Novel Perspectives Html

| Title: Energies Free Full Text Energy Security And Portfolio Diversification Conventional And Novel Perspectives Html Assume That Both Portfolios A And B Are Well Diversified |

| Format: PDF |

| Number of Views: 7190+ times |

| Number of Pages: 228+ pages about Assume That Both Portfolios A And B Are Well Diversified |

| Publication Date: August 2018 |

| Document Size: 1.4mb |

| Read Energies Free Full Text Energy Security And Portfolio Diversification Conventional And Novel Perspectives Html |

|

The Top 50 Highest Grossing Video Game Franchises Top Video Games Video Game Industry Franchising

| Title: The Top 50 Highest Grossing Video Game Franchises Top Video Games Video Game Industry Franchising Assume That Both Portfolios A And B Are Well Diversified |

| Format: Google Sheet |

| Number of Views: 7156+ times |

| Number of Pages: 134+ pages about Assume That Both Portfolios A And B Are Well Diversified |

| Publication Date: April 2019 |

| Document Size: 1.6mb |

| Read The Top 50 Highest Grossing Video Game Franchises Top Video Games Video Game Industry Franchising |

|

Constructing A Venture Fund Portfolio Model

| Title: Constructing A Venture Fund Portfolio Model Assume That Both Portfolios A And B Are Well Diversified |

| Format: PDF |

| Number of Views: 8129+ times |

| Number of Pages: 150+ pages about Assume That Both Portfolios A And B Are Well Diversified |

| Publication Date: September 2017 |

| Document Size: 2.2mb |

| Read Constructing A Venture Fund Portfolio Model |

|

Energies Free Full Text Energy Security And Portfolio Diversification Conventional And Novel Perspectives Html

| Title: Energies Free Full Text Energy Security And Portfolio Diversification Conventional And Novel Perspectives Html Assume That Both Portfolios A And B Are Well Diversified |

| Format: PDF |

| Number of Views: 7208+ times |

| Number of Pages: 232+ pages about Assume That Both Portfolios A And B Are Well Diversified |

| Publication Date: June 2019 |

| Document Size: 810kb |

| Read Energies Free Full Text Energy Security And Portfolio Diversification Conventional And Novel Perspectives Html |

|

Entropy Free Full Text A Simple View On The Interval And Fuzzy Portfolio Selection Problems Html

| Title: Entropy Free Full Text A Simple View On The Interval And Fuzzy Portfolio Selection Problems Html Assume That Both Portfolios A And B Are Well Diversified |

| Format: Doc |

| Number of Views: 3173+ times |

| Number of Pages: 298+ pages about Assume That Both Portfolios A And B Are Well Diversified |

| Publication Date: February 2021 |

| Document Size: 1.1mb |

| Read Entropy Free Full Text A Simple View On The Interval And Fuzzy Portfolio Selection Problems Html |

|

Assume that both portfolios A and B are well diversified that ErA 12 and ErB 9. Assume that both portfolios A and B are well diversified that ErA 22 and ErB 17. If the economy has only one factor and A 17 whereas B 13 what must be the risk-free rate.

Here is all you have to to read about assume that both portfolios a and b are well diversified Assume that both portfolios A and B are well diversified that Er_A. If the economy has only one factor and beta_A 13 whereas beta_B 09 what must be the risk-free rate. Dont use plagiarized sources. Energies free full text energy security and portfolio diversification conventional and novel perspectives html energies free full text energy security and portfolio diversification conventional and novel perspectives html the top 50 highest grossing video game franchises top video games video game industry franchising constructing a venture fund portfolio model the risk contribution of stocks the hedge fund journal entropy free full text a simple view on the interval and fuzzy portfolio selection problems html Solved Expert Answer to Assume that both portfolios A and B are well diversified that ErA 11 and ErB 9.